Current Ratio Formula Example Calculator Analysis

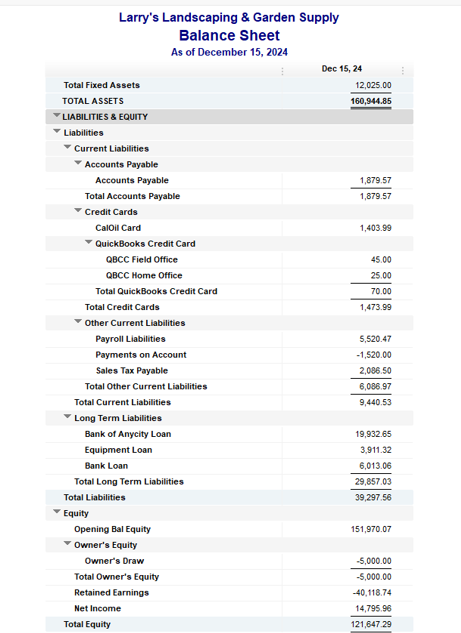

Both current assets and current liabilities are listed on a company’s balance sheet. Let’s look at some examples of companies with high and low current ratios. You can find these numbers on a company’s balance sheet under total current assets and total current liabilities.

Current Assets

The current ratio may be more optimistic, while the acid test ratio gives a more conservative view of the company’s short-term financial position. The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets.

Company

One way they can speed up collections is by shortening credit terms. For instance, businesses can consider reducing the time customers have to pay from 60 days to 30 days. So, it’s normal for such companies to have slightly lower acid tax calculator return and refund estimator 2020 test ratios. On the other hand, tech companies (which don’t usually hold many physical products) will often aim for higher ratios. ” analyzed the complete transaction history of the Taiwan Stock Exchange between 1992 and 2006.

Get paid faster (improve accounts receivable)

The current ratio is one of the oldest ratios used in liquidity analysis. The current ratio is part of what you need to understand when investing in individual stocks, but those investing in mutual funds or exchange-trade funds needn’t worry about it. In general, a current ratio between 1.5 and 3 is considered healthy. Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital. These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds.

Free Course: Understanding Financial Statements

Current assets refers to the sum of all assets that will be used or turned to cash in the next year. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. So, a ratio of 2.65 means that Sample Limited has more than enough cash to meet its immediate obligations.

Generally, the assumption is made that the higher the current ratio, the better the creditors’ position due to the higher probability that debts will be paid when due. It’s the most conservative measure of liquidity and, therefore, the most reliable, industry-neutral method of calculating it. A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly.

If a company’s current ratio is less than one, it may have more …